(Cartoonist: Mike Baldwin; Cartoonstock.com)

We all know that rates in the U.S. are going up. When – Sep or Dec doesn’t matter. Markets seem to be ‘fed up’ with the lack of clarity from the Federal Reserve. What the markets want, is for the debate to end.

Which rate is the Fed expected to hike?

The U.S. Federal Reserve at its meeting on September 16-17, 2015 will take a decision on increasing interest rates. A rate hike in the Fed funds rate by the Federal Reserve will primarily affect the U.S. economy. I think Indian equity investors need to understand that:

-

Banks in the U.S. hold funds with the Federal Reserve. The Fed funds rate is the rate at which banks in the United States trade funds with each other. It is the only rate that the Federal Reserve sets.

- All other rates are derivatives of this rate. It is this rate, popularly called the Fed Funds rate, which the Federal Reserve proposes to hike in its ensuing meeting.

- There is no direct correlation between the Fed funds rate and the Indian economy. The fear is that it can affect flows from Foreign Institutional Investors (FII’s) into Emerging Markets (EM’s) like India.

What a Fed rate hike won’t do

Everyone is obsessed with rising rates and relevant scenarios. A word on what rising rates won’t do:

- Rising rates won’t be able to predict the direction of the Indian stock market in the longer term. In the immediate term, any decision by the Fed will be followed by market volatility, beyond that expect nothing else.

- After the rising rate scare is played out, money managers will start paying attention to things that matter – earnings growth, value and pricing. At present, everything is being blamed on the Fed.

- The pace of the rate increase is something that will remain unclear whatever the outcome of the Fed meeting. The Fed chair has, in the past, made it pretty clear that she is in favour of a gradual rate hike. She has also said that any rate hike will be a ‘one and done’ kind of a thing.

- In other words, a Fed rate hike at the ensuing meeting of the Federal Reserve in the U.S. will not tell us anything about where rates will be a year from now. In my opinion, where rates will be a year from now is far more important than the outcome of the upcoming Fed meeting.

The Fed rate and flows into Emerging Markets (EM) and India

Foreign Institutional Investors (FII’s) yanked a record $2.6 billion from Indian stocks in August. It is one of the largest monthly outflows from India since 2008. It does seem to me that the FII’s have taken some money off the table or reduced exposure, as a precursor to the ‘Fed event’. Apart from this, common sense suggests that FII selling could be on account of all or any of the following three reasons:

- Disappointment over the lack of reforms due to political gridlock. The threat that growth prospects would be further hampered due to poor rainfall seems to have added to FII angst.

- Better opportunities in other Emerging Markets.

- Sovereign risk, which means the fear of currency instability leading to country default.

In my opinion, FII selling has been primarily due to reason number 1 stated above. Why am I saying this? To understand this, the FII selling statistics have to be put into the correct perspective. Consider the following:

- Fund managers who invest globally had increased their exposure to India in recent months. At the end of July, across the Emerging Markets universe, there was an increase of roughly 10.7 percent in the quantum of funds that were allocated to India. This represents an increase in allocation of approximately 40 percent from the quantum of funds that were assigned to the Indian market at the beginning of 2014.

- During the same period, it seems that the allocation to China rose by 17 percent. Clearly, India was the market ‘darling’ among the EM pack. Money managers felt that there was more of an opportunity in Indian markets as compared to other countries in the EM space. Their subsequent disappointment led to a sell-off in Indian equities.

- The surprising part is that the outflow of funds from Indian stocks in the month of August 2015 surpassed outflows from Brazil. In Brazil, stock market outflows were 940 million, much lower than those from India. This is despite the fact that the Brazilian economy has been hit very badly by the commodity meltdown.

- It is apparent that the disappointment with the Indian stock market was large. The verdict: the Indian stock market was hurt because of its ‘darling’ status.

FII selling does not seem to be due to reason numbers 2 and 3 in the list above since:

- The consensus opinion is that India, Mexico and Philippines are the EM’s worthy of investment. I do agree that talk of India replacing China as the vehicle of global growth is a bit preposterous. However, ex-China, the fact remains that the Indian economy is expected to grow faster than other countries in the EM space.

-

If there were a risk of sovereign default, the FII’s would be selling aggressively in the Indian debt market represented by government securities. As on date, this doesn’t seem to be happening.

Why are investors afraid of the Fed rate hike?

In a nutshell, the fear is that Emerging Markets have been beneficiaries of the easy monetary policy followed by the Federal Reserve since the calendar year 2009. The tale has it that Emerging Market Equities are bloated and Emerging Market Currencies have appreciated, since the advent of Quantitative Easing. As a result, when the Fed starts hiking interest rates there will be chaos on both these fronts in the Emerging Markets space. If one looks specifically at the Indian market, this is a myth. Take a look:

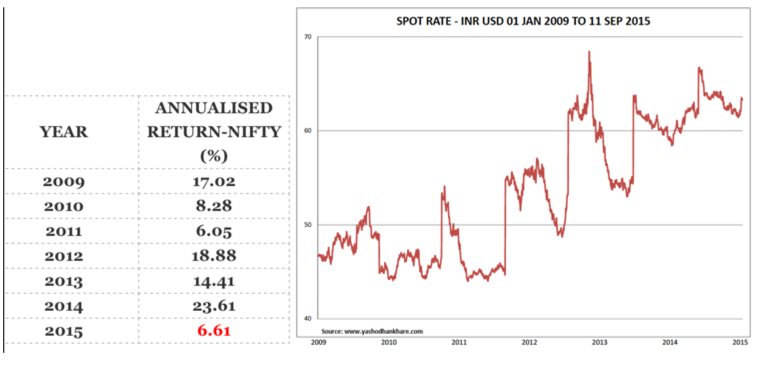

The two images placed side by side, show the annualised returns from the Nifty and the INR-USD parity, from 01 January 2009 till date. From the above it is apparent that:

- The annualised returns in Indian equities are not exactly the type that suggest that the Indian stock market has benefitted as a result of Fed policy. If one excludes the calendar year 2014, returns are more in the normal range.

- The Indian Rupee (INR) just seems to float lower and lower irrespective of Fed policy. There has been no INR strengthening on account of quantitative easing. The INR has been depreciating steadily. Expecting even more INR weakness when the Fed hikes rates is a bit pessimistic. Prima facie, the forex market seems to have discounted a Fed rate hike.

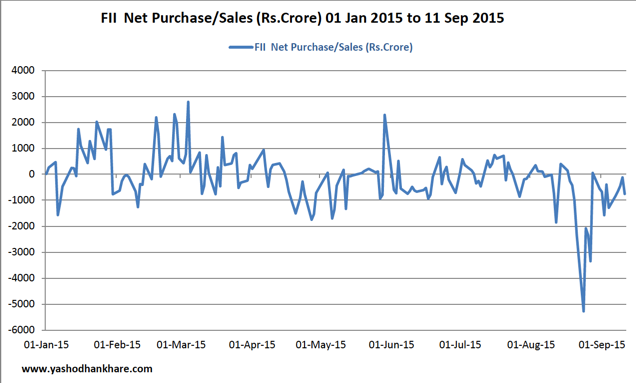

Hence, I feel that the current negative FII investment sentiment towards the Indian equity market is a temporary phase. FII selling on account of the ‘Fed event’ seems to be done. It does appear to be tapering off. Have a look at the image below:

The investment case for FII’s to return to the Indian markets, irrespective of the Fed rate decision, can be summarised as follows:

- From an investment standpoint, for any global investor, all EM’s cannot be bracketed together when making investment decisions. No investor can take a blanket call on EM’s without looking at the economies of the component countries. At the current juncture, Asia, in particular, is trading as if it were just one country. I don’t this will continue for very long.

- Political gridlock does not mean the end of the reform process. Political gridlock does mean that reforms will get stymied. It does not mean that there will be no reforms altogether. It only means that reforms will get tweaked due to political compulsions.

- The concerns about deficient rainfall are priced into the current valuations.

Does the Fed rate hike matter?

As a thumb rule, in markets, risks are greatest when they are not perceived. Currently, markets seem to be ‘prepared’ for a Fed rate hike. At the same time, markets don’t like uncertain environments. If the Fed gives a clear direction of its monetary policy the markets should ‘behave’. I would interpret a rate hike by the Fed as an ‘all is well’ signal. The converse is also true. The following pointers might help:

- Corrections and financial crisis are not the same. Market corrections always out-number market crises. I prefer to treat the current phase as a correction and not a crisis.

-

The sideways nature of the market has clearly broken to the downside. The discussion is now whether we are in a bear market or a bull market or a cyclical bear within a long-term bull market or whatever. I haven’t the foggiest about any of this. I am not aware of anyone who has. In market parlance, this kind of prognostication is called ‘Chauffeur knowledge’.

-

‘Chauffeur knowledge’ is the prognostication of market scenarios by people who are low on knowledge, but have learned how to talk and have a convincing baritone. These guys do tend to make one hell of an impression on the listener. More often than not, ‘Chauffeur knowledge’ is cynicism masquerading as wisdom. Listen to it at your peril.

In my view the Indian stock market was inflated with unreasonable expectations from Modi Government. As you rightly mentioned it may take some more time to pan out on a few strategic steps of reforms like Public-private partnership in defense sector, GST, ease in labour laws, banking licences domestically and our crucial role in ADB internationally.

The mansoon this time is a big negative we are facing currently. Fed and its rate effect may have only a marginal impact, as this factor is already discounted. DII are jubilant on our market and telling unbelievable figures (on the upside) of NIFTY and SENSEX. FII will continue to be bullish on our economy, in EMs. It is no more surprise when we see these rich people talk from both the sides. We have also seen that if somebody looses interest, somebody also endorses our economy vigorously. I think it all depends upon their positions in our market!

To conclude: It seems it may take some more time to reinforce our strength and probably we may not see much happening during that period of about 2 to 3 quarters. Taking a stance is utmost necessary before taking a leap, isn’t it?

Yes. I agree.The market has become a victim of its own expectations. Currently, we are in Wait & Watch mode!