(Cartoonist: Paresh Nath; Cagle Cartoons)

Negative interest rates – the thought or the utterance of such a phenomenon would have been scoffed at, as recently as a year ago. They are now, a reality. The implications are confusing, and that is putting it mildly. In the meanwhile, market volatility has been rising. Volatility is the only factor that has played out as expected.

Non-Mandatory Disclosure

Last week I was reminded of Behram Contractor who wrote under the pseudonym of ‘Busybee’. He was India’s version of Art Buchwald (who wrote a satirical column, syndicated to many American newspapers). I never read Art Buchwald, but I did read plenty of Busybee’s – Round and About columns. That was years ago, when I was in my teens. Busybee’s columns were satirical, he rarely wrote on markets. His style was inimitable. Brevity was his forte. His sense of humour – unmatched in the annals of Indian journalism. If you want to tickle yourself, head over to the real thing by clicking here. My favourites are the ones on ‘Bombay’, ‘Round and About’ and ‘Stray Thoughts’. I decided to ape his ‘Stray Thoughts’ style for the next sub-section of this post. I hope you enjoy reading it as much as I enjoyed writing it. (Just to differentiate, I have italicised the portion that is written in the ‘Busybee’ style).

Are negative interest rates the new Y2K?

And, for a Monday morning, a few stray thoughts and a few general observations and a few points of view ( all my own work):

Like many people are wondering if negative interest rates are the new Y2K. And that even if they were, we won’t know until it’s too late.

Like most economists and central bankers believed that interest rates were held by a so-called ‘Zero Lower Bound’ (ZLB), below which they could not go. Now the consensus is that the ZLB is much lower than zero. And that now that interest rates have settled comfortably below zero, everyone is trying to guess how low they will go.

Like now all the Europeans are going to keep their savings at home stashed away inside and underneath mattresses. Why not spend the cash instead? And if they start doing that, it could lead to inflation, which was their objective in the first place.

Like Gold and precious metals are getting hammered as the U S dollar strengthens. That Gold was supposed to be a store of value, wasn’t it? And that all of this is getting a bit confusing for everyone.

Like European banks are finding it difficult to grapple with technological issues that have arisen as a result of the negative interest rates. Historically, all systems were built in a way that banks were to pay interest on deposits. The systems assume that interest rates are positive and will stay positive. Banks and brokerages are now unsure whether systems and processes will work as smoothly with negative interest rates as they have till now. And that they still have to contend with something called ‘floating interest rates’.

Like things like risk management also need to factor in the effect of negative interest rates. And that the systems instead of the banks should be subjected to ‘stress tests’.

Like very few people have noticed that the yields on Euro zone bonds have now fallen below those of Japanese bonds. Low yields in Japan were hitherto taken as a sign of deflation. And that even lower yields in Europe are being taken as a sign of revival.

Like most of the central banks and the central bankers of the world are already in a mess – talk about being wrong and staying wrong in financial markets!! And that they should pay the Reserve Bank of India to use the services of our very own Raghuram Rajan, who by almost any metric is the best central banker in the world today.

Like Raghuram Rajan brings with him a lot of trust in India’s monetary policy. It in not a coincidence that the FII’s suddenly started liking India from Nov 2013, even before the election of Modi and that Raghuram Rajan took office in Sep 2013.

Like the recent budget is internationally referred to as Modi’s budget and not Jaitley’s budget. In the past, we always had the PC budget and Pranab budget and the Yeshwant Sinha budget. And that I am feeling sorry for Jaitley.

Like there used to be Bulls and Bears in the good old days. And that now we only bear’s. In bull runs they used to say that the bears are hibernating, in bear runs they said the opposite. How can there be only bears in a bull market? The bears have procreated and evolved. Technology you know, now we have a new breed – fully invested bears!!!!

Like it is fashionable for the financial media channels to have a beautiful face uttering words like colour, flavour and run-rate. And you must be kidding me if you think that any of the male-dominated investment community is listening – they are only looking, with the volume set on mute!!

And this final point of view:

Like Parsis’s come in two types. Either you love them or hate them. Busybee was the lovable type, gosh I wish I could submit one of my blogs to him for editing. And that our media needs Busybees, and so does our capital market.

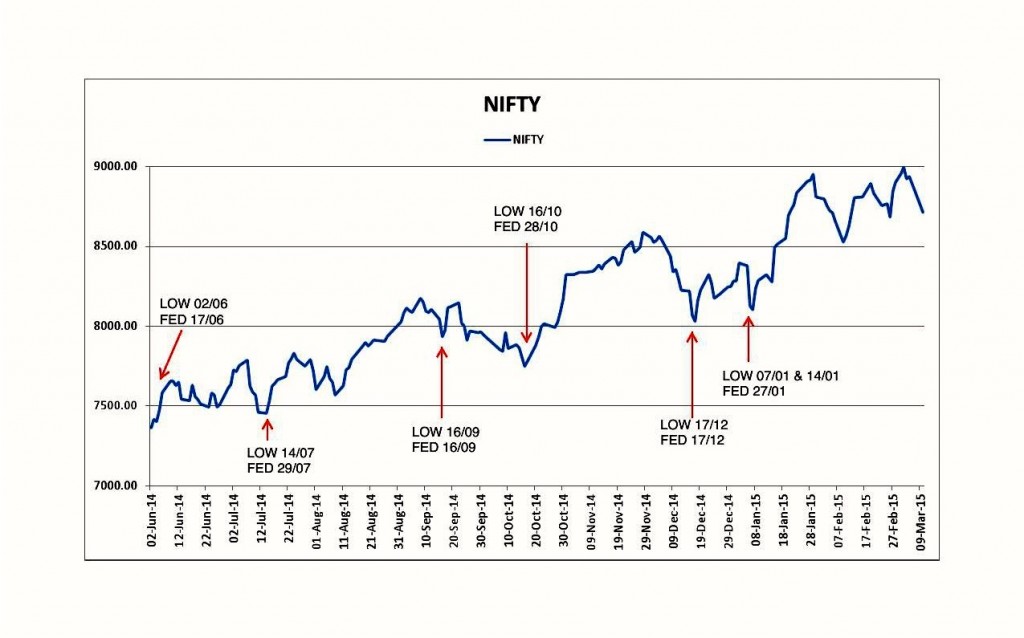

Waiting on the Fed

Rate hikes don’t upend bull markets. I did my analysis and found that market volatility occurs prior to every meeting held in the recent past. After the meet, the market shrugs off all the ‘fed speak’ and resumes its ascent. All preceding corrections leading up to the Fed meet have been buying opportunities. Will it be ‘different this time?’ The Nifty chart from 01 June, 2014 till date looks like this:

In my opinion, the following points merit consideration:

-

The inevitability of a rate hike is now seized upon all market participants. Most market participants believe that we are inside the six-month window which will lead to the first Fed rate hike.

-

There is no rate increase as of now. Everyone is speculating on the timing of the first-rate increase. I think this point is lost on most of the market participants in India. Many investors I spoke to were under the impression that rates will rise from next week itself.

-

Whether the Federal Reserve will drop the word ‘patient’? Is the federal reserve ‘hawkish’ or ‘dovish’? The Fed on its part might as well give a date like they did when they stopped QE. The fact that they are not announcing any dates means that they have no clue. That is letting the cat out of the bag!!

-

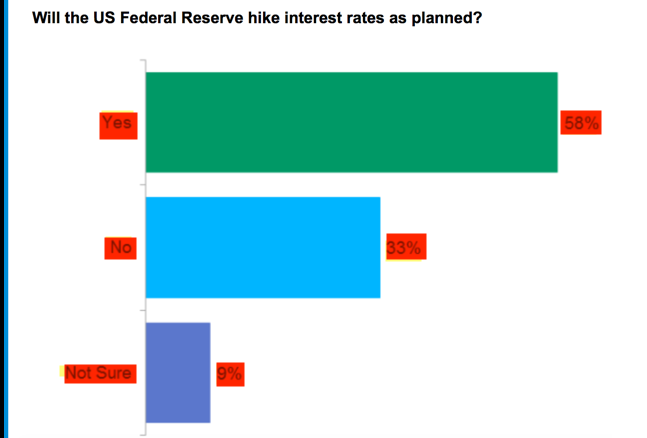

If you talk to any Indians settled in the U S or any native American citizens, you will find that they want the interest rates to rise. So, as they say, they are all invested on Wall Street or in fact working on Wall Street but they are living on Main Street. My point is that the question of federal reserve rate increases is more of wishful thinking than anything else. The CFA institute did a survey of 873 respondents, who were asked whether the Fed might go through with its proposed rate hike. This is how the results look:

(Excerpted from the CFA Institute newsletter)

-

Click here to get the Fed’s agenda for all the meetings to be held in 2015. In case you are thinking of putting reminders a week or ten days in advance, just to be prepared, I have already done that. That is a sure sign that nothing will happen at any of the meets!!

Will She, or won’t She (increase interest rates); that is the question?

I think Janet Yellen faces a dilemma of Shakespearean proportions when the Fed meets in the next week. I wish to highlight the following:

-

There is a difference between the Fed and Central Banks all over the world, including India. In India, the RBI is primarily focussed on monetary policy and inflation, so are most of the central banks all over the world. In the U S, Janet Yellen’s Federal Reserve is unique – it has a dual responsibility – full employment and stable inflation. In a situation where the price of oil is hurtling towards ‘ground zero’ the question of inflation is passé, there isn’t going to be any.

-

If interest rate hikes in the U S are the only way this market is going to come down, I dare say that we aren’t going to see any in the near future. The investing population can keep procrastinating about their ‘buy’ decisions before every fed meet and miss the opportunities.

-

However, markets can correct for myriad reasons and in my humble opinion, that is what is most likely to happen. We are already in a correction phase on the Nifty. I am sure about one thing – if this market were to surprise on the downside, it would not be a function of the Fed or interest rates, but for some completely unforeseen reason. Why and when – keep guessing!!

I love the style. Carry on and innovate every now and then to keep the eye-balls on your blog, which is already rich in content!

I particularly “like” the one “Like it is fashionable for the financial media channels…”.

My humble opinion is that the “male” analysts on these fashionable channels do no better. :–)

Ha Ha. Thanks, Vinay. Take a look at this link

http://www.busybeeforever.com/viewart.asp?section=roundandabout&filename=bombay523200550032.xml&subsec=bombay

Changes are good one.

Thanks