Cartoonist: Morris, John; cartoonstock.com – Sunday, 1 January 2017

It does appear that forecasting has become little more than an excuse for sloppy thinking. Hence, it would be easy to conclude that we should ignore forecasts altogether. But just as we don’t throw out an ideology because it has been used disingenuously, we shouldn’t be too quick to dismiss forecasting skills.

Burton G Malkiel in his seminal book A Random Walk Down Wall Street – The Time-Tested Strategy for Successful Investing has famously written: “A blindfolded monkey throwing darts at a newspaper’s financial pages could select a portfolio that would do just as well as one selected by experts”. The phenomenal popularity of the book ensured that the ‘dart-throwing chimpanzee’ became famous in the investing world. Many in the investing world argued that Malkiel may have given too little credit to monkeys! I always believed that what Malkiel had written was based on some original research. It turns out I was wrong.

Malkiel’s reference to the ‘dart-throwing chimpanzee’ was the result of research on forecasting skills made by a researcher called Philip Tetlock. After studying the accuracy of thousands of predictions made by experts in various fields, Tetlock came to the conclusion that the accuracy of the average expert was roughly what one would get by random guesswork. Tetlock used the analogy of the ‘Dart Throwing Chimpanzee’ to draw the attention of the world to his research on forecasting.

Philip Tetlock went on to write a book titled Superforecasting: The Art and Science of Prediction. In the book, he clearly states that the reference to the ‘dart-throwing chimpanzee’ was meant to be a joke. In his words:

“But as in the children’s game of “telephone,” in which a phrase is whispered to one child who passes it on to another, and so on, and everyone is shocked at the end to discover how much it has changed, the actual message was garbled in the constant retelling and the subtleties were lost entirely. The message became “all expert forecasts are useless,” which is nonsense. Some variations were even cruder—like “experts know no more than chimpanzees.” My research had become a backstop reference for nihilists who see the future as inherently unpredictable and know-nothing populists who insist on preceding “expert” with “so-called.” So I tired of the joke….”

What Tetlock meant by using the dart throwing analogy was that the average expert did as well or as badly as the guy who was using random guessing as a strategy. Tetlock’s book highlights the fact that some people possess very real demonstrable foresight. These are ordinary people with a forecasting accuracy that is sixty percent greater than regular forecasters. He calls them super forecasters. He seems to conclude that forecasting as a science is fallible but not entirely useless in our understanding of causal mechanisms.

Moral of the story? Not all forecasts are useless. What experts think is a poor predictor of outcomes. How they think is a more consistent predictor of results. Those of you who are serial forecasters and want to graduate as super forecasters (with a view to improving your forecasting skills and the related outcomes) the Good Judgement website is a good place to get started. The site is co-founded by Philip Tetlock, and they call it ‘crowd-sourced forecasting’.

Markets Diary

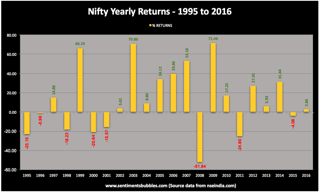

Shifting gears to market action, the Nifty ended the week in positive territory, despite selling by Foreign Institutional Investors (FII’s). Nifty returns were lacklustre for the second consecutive year. The final tally for the Nifty and the historical performance is shown below.

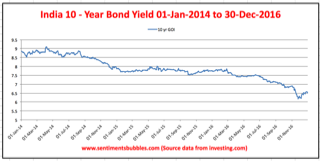

The fact that interest rates have been falling is well-known. In my opinion, the yield on the 10 Year Government of India (GOI) Bond can be safely used as a leading indicator of the direction to show the historical trend of the interest rates metric.

In the Bond market, as yields continue to fall the price of the underlying Bond continues to rise. The Total Return for a Bond investor is a function of the capital appreciation in the price of the Bond and the coupon rate. Over the last two years, the Total Return on Income Oriented products has been closer to twenty percent. In other words, Income Oriented Mutual Fund Schemes have outperformed their Equity Oriented counterparts for the second consecutive year. The question is: Will the trend continue in 2017? My thoughts:

- If interest rates continue to fall, the likelihood that bond investors start acting like stock jockeys is high. Another popular notion doing the rounds is that ‘everything else remaining the same’, Income Oriented Mutual Fund Schemes will outperform the Nifty for the third consecutive year in 2017. The problem is that in the investing world, ‘everything else remaining the same’ is a misnomer; it is never the case.

- Are Bond prices out of kilter with fundamentals? Difficult to say. According to me, fundamentals don’t matter, and yields can go far lower if interest rates continue to drop. By a historical metric, Bond prices look expensive, and debt markets look overheated. That means nothing, since what looks expensive can become even more expensive and what looks overheated can start to boil.

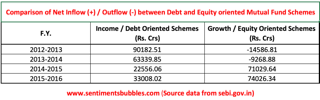

- The retail investor has embraced Mutual Fund Schemes in a big way over the last two years. Investing in Equity Oriented Mutual Fund Schemes is a proxy for the Indian Stock Market and Investing in Income Oriented Mutual Fund Schemes is a proxy for the Indian Debt Market. The break-up of flows into these two types of schemes is shown below. From the numbers, it doesn’t look like retail investors are betting on fixed income products in a big way.

- Is a falling interest rate scenario good for stocks? The jury is out on that; there are no clear answers. However, interest rate changes are the primary drivers of bond returns. One thing is sure, falling interest rate scenarios are good for the Fixed Income Investors.

- Will interest rates in India be ‘lower for longer’? I don’t fancy myself as a super forecaster and am unable to hazard a guess. My sense is that even though interest rates in the United States have moved higher, interest rates in the Euro zone and Japan continue to be in negative territory. There are still more than $10 trillion of negative-yielding bonds globally. In such a scenario, common sense suggests that an uptick in inflation readings in India (and globally) can spoil the party in the Indian Bond Market, not otherwise. In 2017, will inflation be the dog that did not bark?

- The consensus forecast for 2017 is for lower interest rates, lower inflation, lower growth and higher Nifty levels. That doesn’t quite make sense, does it? If that were to be an accurate forecast, buying bonds, not stocks is a cinch. Probabilistically speaking the odds of something happening a third time in a row, are very low. Markets have taught us to beware of irrational exuberance. In the age of social media, what we need to guard against is irrational equanimity instead.