In the world of Mutual Fund Investing, one can be an active investor by investing in an actively managed fund or a passive investor by investing in an index fund. How does one decide as to how ‘Active’ a money manager in an Actively Managed Fund is? That’s what ‘Active Share’ is all about.

Passively managed funds are those that mimic the benchmark. Actively managed funds are the ones whose composition varies from that of its benchmark. The idea is to outperform – deliver returns that exceed the stated benchmark; generate Alpha as they say. The concept of Active Share applies to Actively Managed funds and not the passive ones.

What is Active Share?

Active Share is the proportion by which an actively managed portfolio differs from its stated benchmark. Active share varies from tracking error. Tracking error is the difference between the returns of the scheme and those of its stated benchmark.

An active manager can achieve higher returns than that of the benchmark in two ways, (a) either by selecting stocks that do not form part of the benchmark composition and (b) by timing the trades precisely so as to be able to buy low and sell high.

Money managers manage actively managed portfolios. Between different active portfolios, each active portfolios would necessarily differ in its sector/stock allocation and the weight of individual stocks in their respective portfolios. When distinguishing between different types of active managers, the question that comes to mind is: How should active management be measured?

The debate about ‘Active Share of a Mutual Fund Scheme’ was set in motion by research conducted by K.J.Martijn Cremers and Antti Petajisto. Their paper is titled How Active is Your Fund Manager? The researchers argue that an active manager can only add value by deviating from his or her stated benchmark. Some level of Active Share is required, how much? Interested readers can click on the link and read the paper. I’ll stick to the background information that is necessary for understanding the concept of Active Share. Here goes:

- To reiterate, Active Share (AS) of a Mutual Fund Scheme is the portion of a scheme’s portfolio that differs from its stated benchmark composition. For example, an Index fund that mimics the benchmark would have an AS of zero and a managed fund that holds no stocks that are in the index to which it is benchmarked, would have an AS of 100. The higher the AS, the better is what the research suggests.

- The researchers have devised a formula to measure the Active Share of any given benchmarked portfolio. According to them, an AS of anything less than sixty percent would mean that the portfolio of the active manager is hugging the index composition. They call such Active Managers ‘Closet Indexers’.

- The research highlights the fact that funds with close resemblance to their stated benchmark are not really ‘Active.’ What it seems to suggest is that many funds are charging fees for running portfolios that in effect mimicked the benchmark index, with small variations. Active Share exposes managers who claim to be active but in reality are dong little more than passively track their benchmark index.

How is Active Share Calculated?

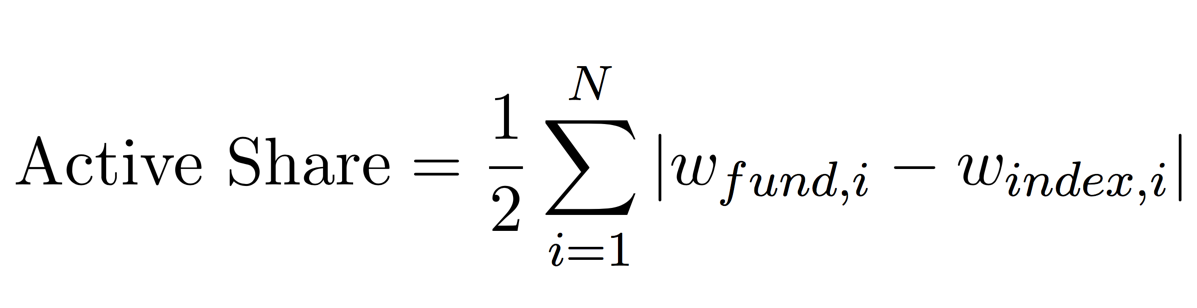

To compute Active Share, the portfolio holdings are compared with the components of the Index to which the portfolio is benchmarked. Active Share (AS) is calculated as half the sum of the absolute weight of all securities in a portfolio. The formula looks like this:

There is no reason to get intimidated by the formula. In fact, Active Share is very easy to compute. To do an unbiased analysis, one needs to calculate the AS of a portfolio over the long-term. In this way, the changes in the composition of the portfolio can be compared with the changes in the Net Asset Value of the portfolio. One can then compare it with the returns generated by the index to which the portfolio is benchmarked. To compute Active Share, the report date of fund holdings has to match the date of index holdings – this information is not readily obtainable on any given date. Neither are the full data sets of changes in portfolio composition. As a result, empirical verification was not possible. It wouldn’t be fair to pass judgment based on a partial analysis. Hence, I decided not to present the calculations here. The point is that the Active Share of any fund can be easily computed once the data is made available. Maybe, this information can be made available in response to a specific request. We are investing in the information age, aren’t we?

What does Active Share signify?

Active Share is a very useful for analyzing managed portfolios. Hence, Active Share can be used as a tool for fund selection. I should hasten to add that it cannot be used in isolation and for short-term performance analysis. It has to be used as a guideline in conjunction with other tools.

The main advantage of the methodology is that it allows us to distinguish between different types of active funds; one can then focus on the ones that are active in the true sense. The central insight from the research papers is that funds with high Active Shares and long holding periods are statistically favored to outperform in the long run. The following points are worth mentioning:

- A high Active Share coupled with outperformance would act as an endorsement of the skills of the fund manager. It would serve as a testament to his or her stock-picking capabilities. Reason being, it signifies that the fund manager has delivered a superior performance without hugging the benchmark index and by his or her stock picking skills, rather than anything else. Investing in an actively managed fund means paying for someone with superior money management skills. Why else would one invest in an actively managed fund?

- According to the researchers, a high Active Share would also indicate a higher probability that the Mutual Fund Scheme in question would continue to deliver superior returns in the future as well. In other words, in the case of funds that boast of a high AS and outperformance, to some degree, past performance is indicative of future returns.

- In cases where the Active Share of a Mutual Fund Scheme is low, it would mean that the composition of the scheme correlates very closely with its benchmark. Effectively, one is paying too much by way of fees for buying most of the index components. In such a scenario, investing in a passively managed Index Fund is a cheaper option.

- How do we know whether or not the fund manager is a charlatan? Active Share is a means of finding out. Active Share can be used to track a fund’s style changes over time, or even from one-quarter to the next or when there is a change in the fund manager.

Conclusion

As with everything else in the investing world, Active Share is not a silver bullet. The issue of whether a high Active Share would necessarily result in outperformance has been debated extensively. Many funds having a low AS may outperform and those with a high AS might end up underperforming. Everything depends on the fund composition. However, a high Active Share would improve the probability of outperformance and its sustainability. There is no doubt about that.

Closet index tracking has been labeled as a form of mis-selling, by some commentators. Buying a fund that hugs the benchmark is likened to ‘buying a Ferrari and finding a Fiat engine under the bonnet.’ I like the analogy.